How will Ghana cope if 2011 oil price falls to $60/barrel?

As Ghana looks forward to becoming an oil producing country, its government, corporate sector and ordinary citizens are increasingly going to be paying closer attention to trends in global oil and gas prices.

Although oil is not expected to be such a dominant force in Ghana’s economy as it is in the economies of some other African countries, such as Nigeria or Angola, its fluctuating price is bound to affect development plans of the country. According to a report made available to GB&F by Damina Advisors, a New York-based political risk advisory firm, several African oil exporting countries including Ghana and other countries such as Algeria, Chad, Cote d’Ivoire, DR Congo, Egypt, Gabon, Libya, Mauritania, Nigeria and Sudan are likely to experience a rude budgetary awakening and consequential political shocks if or when in 2011, oil prices likely collapse to recent

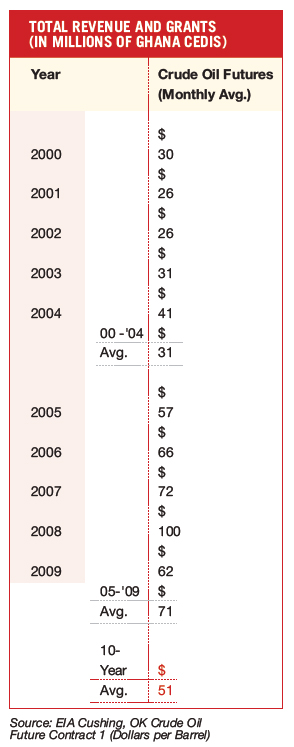

5-to-10-year historical average prices of between $51 to $71 per barrel.

For most African oil exporting economies, global oil price levels have a significant impact on government revenues because of the significant role that oil exports play as a percentage of GDP. Oil generates an exogenous flow of revenue that has a significant impact on the budget process.

African oil exporting nations could face an adverse pricing environment, which will deteriorate their export earnings used to fund their domestic budgets. Although Ghana will not produce enough oil to make it an OPEC member, and oil will not become its major export revenue earner, its citizens and business community will hence have to pay more attention to the decisions of OPEC and to developments in the oil sector, especially the decisions and actions of other African producers.

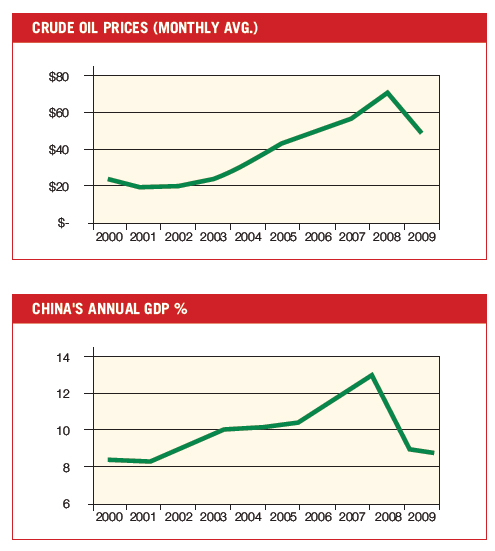

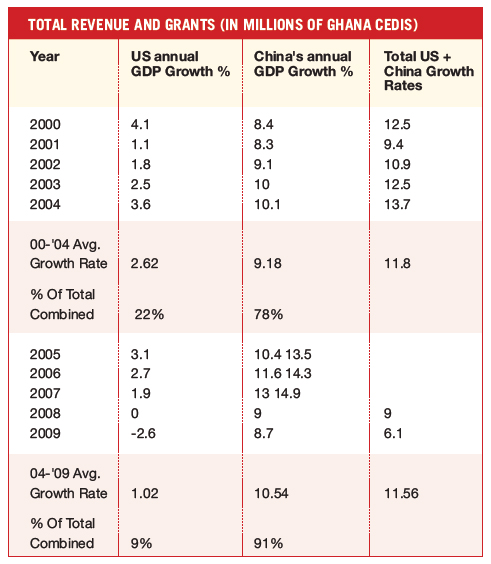

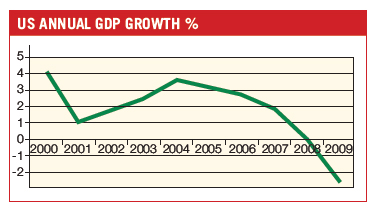

According to Damina, with European energy importing countries already enacting across-the-board austerity measures, and draconian US spending cuts certain to take place after the November mid-term elections, global oil price levels will increasingly be dictated by Chinese GDP growth patterns. Since 2001 the swings in global oil prices have carefully tracked Chinese growth patterns, says Damina. Between 2000 and 2005, China and the US (the two largest consumers of crude oil) had a combined GDP growth rate of almost 12% (with China accounting for 78%).

However, by early 2010, while the combined GDP of China and the US had remained stagnant at around 12%, the US portion of that percentage had fallen from 22% in the 2000-2004-period to only 9% in the 2005-2009-period.

Yet, during the same period, average crude oil prices more than doubled from 2000-2004 monthly averages of just $30/barrel to over $70/ barrel on average by the end of 2009. By implication, according to Damina, oil prices exceeding $80 a barrel on a sustained basis is historically unsustainable.

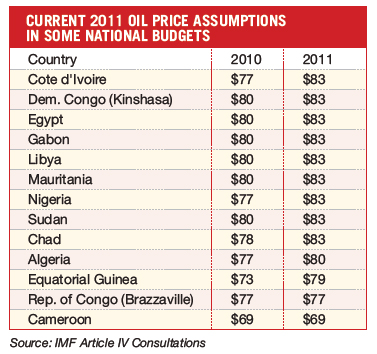

As such, any oil producing countries such as Ghana that may be basing their national budgets and expected revenues on oil prices that would average more than US$80 may end up with potential budget deficits. Statistical analyses clearly show that over the

5-year periods between 2000 and 2004, and 2005-2009, the aggregate combined GDP growth levels in China and the US did not change much. Both periods saw the two major energy importing countries grow at a combined GDP growth rate of almost 12%.

While the US started the decade from a GDP base of $9.9 trillion and ended the decade at roughly $14 trillion (an increase of 29%), China’s GDP base was $1.2 trillion in 2000 and $5 trillion in 2009 (a 76% increase). The International Monetary Fund (IMF) estimates that over the next five years, China’s GDP will almost double to $10 trillion with an average annual growth rate of about 9.7%. During the same period, the IMF expects US GDP to grow to $18 trillion on an average annual growth rate of about 2.4%. OPEC’s 2009 world economic outlook expects the global recession to end in 2012 and not by 2011.

Importantly, OPEC estimates that the US GDP growth rate in 2011 will be 1.7% (less than the 2.9% estimated by the IMF). OPEC also predicts that the Chinese growth rate in 2011 will be 7.7% (less than the 9.6% estimated by the IMF). Furthermore, the OPEC Outlook mentions the viability, effect and sustainability of the current

extraordinary fiscal and monetary measures as being very likely to impact the price of crude in the near-term.

However, despite the recent crude price gyrations, it is becoming abundantly clear that all the major OECD economies are instituting one form of austerity or another - ruling out the possibility of further major fiscal stimulus. US GDP growth is very likely to decline and stagnate over the next few years as the country repairs both its government and consumer balance sheets and grows savings levels. This phenomenon will likely leave China as the single most important structural determinant of average crude prices in the 5-year outlook. What about major potential oil supply shocks?

A cursory observation suggests that neither Iran, Venezuela, Iraq, Russia nor Nigeria (the usual suspects) is likely to pose any major threats to global supply in 2011. Despite Iranian President Mahmood Ahmedinejad’s bellicosity, the country is cooperating with other major powers to allay fears about its nuclear program. Israel, which had openly threatened to bomb Iran, is now concerned about its frayed relations with long-time ally Turkey and cognizant of the 2011 Egyptian elections, is unlikely to strike Iran in 2011. In Venezuela, President Hugo Chavez, having lost his super-majority in the legislature, is likely to turn inwards, travel less and play nice with the US administration. Iraq, with the success of the US military effort and the “surge” initiated by former President George W. Bush, is likely to actually add more new supply to the oil market. In Russia, Prime Minister Vladimir Putin, with a view towards elections in 2012, will also not seek to curb oil supplies in 2011. While Nigeria is scheduled to make a go at another chaotic election in 2011, historically attacks in the country’s Niger Delta occur before elections - not after.

However even if unexpected negative geopolitical events occur in 2011, the underlying structural stagnant economic growth in the US and slightly decelerating economic growth in China will remain the main drivers of global oil prices.

Therefore, with US growth weak, Chinese growth decelerating, the US likely to enact fiscal austerity measures post November 2, additional monetary easings on hold, and most of the normal supply shock risks somewhat abated, global economic growth is likely to be the main driver of crude prices in 2011. If oil prices in 2010-11 trend as low as $51 to $71, most African countries will see their 2011 budget assumptions in RED. Algeria, Chad, Cote d’Ivoire, Ghana, DR Congo, Egypt, Gabon, Libya, Mauritania, Nigeria and Sudan all still maintain budgetary assumptions for 2011 that are premised on much higher crude prices.

All of the African oil exporters listed here as well as new expectant exporters such as Ghana will be exposed to a potential significant reduction in their fiscal revenues. Additionally, many will face added significant Balance of Payments (BOP) adjustments by shielding their economies from low prices and by abandoning vital projects that contribute to development (e.g. electrification projects, schools, hospitals), curtailing public services, and reducing the government payroll. Wage pressures and potential strikes are likely in Ghana, Cote d’Ivoire, Cameroun, Nigeria, Egypt and Gabon. Others may see a reduction of imports to offset additional oil revenue losses. Countries like Egypt, Gabon, Cameroun and Ghana, which have high debt loads, may find it increasingly difficult to service their mounting debts and interest payments. If global capital markets remain unfriendly to new high yield debt issuance, rollovers and new debt issuances to pay off retired issuances may also not be feasible for several African countries. Tensions may even arise within the OPEC cartel between countries such as Nigeria, Angola and their Middle Eastern peers. Angola has already publicly admitted cheating on its quota.

• In Angola, where 90% of government revenues come from oil, which only forms 45% of the GDP basket, the country may be able to better weather the storm. Already its energy minister has admitted that the country is producing above its OPEC quota and its central bank has recently faced strong countervailing currents while defending the local currency. The transition from longtime President Eduardo dos Santos to a new leader from within the ruling People's Movement for the Liberation of Angola (MPLA) scheduled for sometime over the next two years may be fraught with internal political tensions within the party if oil prices plunge dramatically and the budget goes into a deficit. The ability of the MPLA to also use high oil revenues to assuage the public by investing in high profile infrastructure projects may come to a dragging halt, increasing

youth unemployment in the process.

• In South Africa, the likely benign 2011 global oil price environment will put added pressure on the central bank to cut rates even further as inflation readings drop. The country’s labor unions, which have been at loggerheads with the Zuma administration over wage hikes, may also have the last laugh as it becomes more feasible for the government to capitulate to their demands without major adverse inflationary effects. Moreover the only way Zuma will be able to halt the growing labor union support for the ANC-Youth League’s call for mining sector nationalization may be to hike public sector wages and buy-off the unions. Falling global oil prices will bring temporary political respite to Zuma and kick the nationalization can down the road.

• In Nigeria, the 2011 elections, which are already set to be dramatic because of the run by President Goodluck Jonathan in contravention of longstanding ruling party ‘zoning rules’, will likely be even more tense if an oil prices fall sharply from their present levels and a budget crisis ensues.

If Jonathan retains power, the ability of Jonathan to govern and use government oil revenues to pacify a likely incensed Muslim north in a post election environment will be curbed as government spending is significantly reduced and new bonds are issued by both the federal government and cash-strapped state governments to finance payrolls and day-to-day operations.

Any deluge of fixed income issuances will however drain money from Nigeria’s equity markets and make the ongoing banking sector reforms more difficult to implement.

• Sudan, where a 2011 referendum is expected to be staged to peacefully dissect the country, may also run into both financial and political troubles if oil prices collapse in early 2011. While most of the oil reserves are located in the south or on the border with the south, the northern Muslim bureaucracy has grown accustomed to receiving a bulk of the oil revenues in recent years to fund its own operations.

The peaceful secession of the south would have left the north with less oil revenue, but for that to happen at a time when oil prices are low will be even more painful and probably reignite reactionary elements in Khartoum opposed to the peaceful dissolution of the state - Africa’s largest country by landmass. Plans for a southern pipeline through Kenya may also stagnate

if oil prices fall in 2011.

• In Egypt, where oil exports constitute only 14% of GDP, a fall in oil prices may not have a dramatic effect on the country’s budget, unless concomitantly gas prices also fall.

With major elections scheduled for late 2011, where longtime President Hosni Mubarak is expected to step aside for his son Gamel, or another leader within the ruling party, a significant

fall in government revenues coupled with recent agitations over food price hikes and electricity blackouts will make it impossible to raise taxes-necessitating the issuance of more government

bonds, more foreign loan borrowings among other measures.

• In Gabon, where oil exports constitute 73% of GDP - one of the highest in Africa, a fall in oil prices will not only reduce government revenues and intensify tensions between President

Ali Bongo and the legislature, but the country’s Eurobond may also come under continuous market pressures over whether the country can continue to make its interest payments.

• Ghana, which has yet to commence commercial oil production, but which has already borrowed heavily (against its future oil revenues), could also witness several fiscal headaches. On one hand, Western Eurobond holders, already reeling from a split rating from Fitch and S&P will grow more concerned about the government’s ability to service its debts.

On the other hand, a mismatch between the public’s high expectations of the revenues from the nascent oil sector, and a likely $60 average price environment will dent the government’s public support and complicate the re-election strategy of President John Atta-Mills. Atta-Mills who is already likely facing a primary challenger from within the ruling National Democratic Congress, will also likely have to grapple with new labor strikes and rising domestic discontent.

In sum, while a likely significant fall in 2011 crude oil prices will bring relief to many oil importing OECD countries and South Africa, for most African oil exporting countries, any such fall in prices will cause fiscal stresses and exacerbate pre-existing domestic political tensions in some countries.